- CubCrafters has acquired Summit Aircraft Skis, including the company’s design and manufacturing assets, unique patents, and related intellectual property

- The US Department of Agriculture Wildlife Service recently selected CubCrafters’ flagship FAA-certified CC19 XCub for a new government aircraft-fleet-modernization contract

- CubCrafters is now offering investment opportunities through a Regulation A+ offering – managed through Manhattan Street Capital

Stocks To Buy Now Blog

All posts by Christopher

BiondVax Pharmaceuticals Ltd. (NASDAQ: BVXV) Developing Innovative Inhaled NanoAb Therapeutics for Multiple Indications, Including COVID-19

- Current monoclonal antibody therapies less effective against emerging COVID-19 variants

- BiondVax is developing an inhaled nanosized antibody (NanoAb) therapy for COVID-19 with human clinical Phase 1/2a results anticipated in 2023

- The global monoclonal antibodies market was valued at $185.5 billion in 2021 and is projected to grow at a CAGR of 11.3% due to the rising prevalence of chronic diseases and demand for biologics

- The biologics market size was valued at $366.5 billion in 2021 and is expected to reach $719.94 billion by 2030

Data443 Risk Mitigation Inc. (ATDS) Announces New Contract Wins; Raises Capital to Fund Future Growth Agenda

- In November 2018, Marriott suffered the loss of personal data for almost 383 million guests, highlighting the pitfalls and risks attached to businesses boasting an online profile

- Gartner revealed that 30% of enterprises would employ data security platforms by 2024, up from a mere 5% in 2019

- Data443 caters to the growing need for data discovery, governance, and protection services through its extensive and growing product suite – with services ranging from the data archiving and transfer through to ransomware recovery

- The company recently embarked on the next leg of its growth trajectory, recently raising over $1.5M with proceeds set to be devoted towards additional sales and marketing recruitment as well as the uplisting of the company on to the Nasdaq exchange

- Data443 also updated the market on the coveted VB100 certification which was recently awarded to its flagship Data443(R) Antivirus Protection Manager(TM)

Cepton, Inc. (NASDAQ: CPTN) Kicks off the New Year; Launches Vista(R)-X120 Plus — Ultra-Slim, Next-Gen Lidar for ADAS and Automotive Driving Applications

- Built upon its predecessor–Vista-X90 lidar–that is being used in Cepton’s flagship ADAS lidar program with GM and Koito, the Vista-X120 Plus is designed to significantly enhance lidar performance without compromising reliability, size, power efficiency, and cost

- Vista-X120 Plus advances the company’s vision of enabling safe and autonomous transportation for everyone through mass-market lidar adoption.

- As a member of the Lidar Coalition, Cepton showcased its new product and a comprehensive portfolio of its lidar solutions at CES 2023, one of the most influential tech events in the world; the company demonstrated its adaptive 3D perception and simulations featuring a Chevy Silverado and a Ford F-150 equipped with Cepton’s latest vehicle integration solutions

MetAlert, Inc. (MLRT) In Strong Position Entering 2023 According to CEO Patrick Bertagna

- MetAlert’s CEO, Patrick Bertagna, while appearing in an interview presented by Sequire Spotlight and hosted by Carmel Fisher, expressed his optimism for the new year while also sharing the company’s recent progress

- He discussed the company’s core objective- increasing the quality of life, and longevity of people living with Alzheimer’s, dementia, and autism (“ADA”)

- Bertagna also hinted at potential acquisitions by the company, attributing it to extensive efforts over the past couple of years to clean up its balance sheet

- He noted that as MetAlert’s revenue per user continues to grow, its margins will increase, ultimately placing the company in a position to uplist

While appearing in an interview presented by Sequire Spotlight, and hosted by Carmel Fisher, MetAlert (OTC: MLRT) CEO Patrick Bertagna discussed the company’s recent progress and how well it is poised to enter the 2023 financial year. Of note was his optimism in the new products launched thus far, such as the patented GPS SmartSole, a hub for collecting and transmitting data to the cloud in real-time, and RoomMate, an alert system that detects and alerts caregivers about patient behaviors, without intruding into their privacy (https://ibn.fm/q8cML).

MetAlert, a developer of personal protective medical equipment and supplies and a pioneer in wearable GPS, human and asset tracking systems, has sought to offer viable solutions to individuals afflicted with Alzheimer’s, dementia, and autism (“ADA”). This commitment has informed its approach and the development of its products that have so far gone beyond location-sensitive health monitoring devices to include Concierge, Artificial Intelligence, and the Telehealth platform that allows access remotely to doctors and other health professionals on an as-needed basis.

According to Bertagna, most of its target market cannot use conventional technologies. Because of that, MetAlert has developed a suite of products and services that allow caregivers to provide excellent care to these patients by quickly and efficiently monitoring where they are and how they are doing, and allowing them to send their medical information to their doctors for easier care.

“It is really about increasing the quality of life, the longevity of people that are challenged,” he noted.

Bertagna also hinted at MetAlert’s possible uplisting, having brought on board a leading figure in the private equity and Mergers and Acquisitions (“M&A”) community. He mentioned that the company has a lot planned for the new year, including acquisitions resulting from extensive efforts to clean up its balance sheet over the past couple of years.

“We spent the last couple of years cleaning up our balance sheet. We got rid of all our variable convertible debt, so our balance sheet looks very clean and healthy,” Bertagna noted.

“We think we are very well poised to enter 2023,” he added.

MetAlert has had an strong start to the new year with its Canadian distributor launch of its SmartSole flagship product. Its management, starting with CEO Bertagna, is confident about the company’s continued prospects. Bertagna is optimistic that, as its revenue per user (“RPU”) continues to grow, its margins will increase, ultimately placing the company in a position to uplist.

For more information, visit the company’s website at www.MetAlert.com.

NOTE TO INVESTORS: The latest news and updates relating to MLRT are available in the company’s newsroom at https://ibn.fm/MLRT

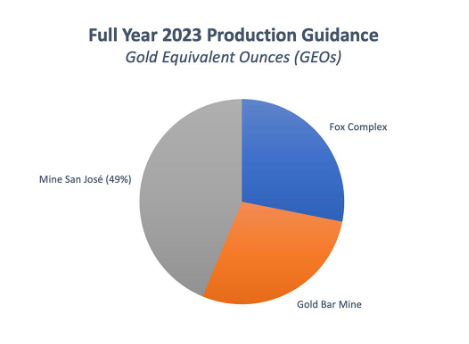

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) Is ‘One to Watch’

- McEwen Mining is an asset rich gold and silver producer with large exposure to copper

- McEwen Mining CEO Rob McEwen maintains a 17.3% ownership stake in McEwen Mining with a cost base of roughly $220 million

- McEwen Copper’s Los Azules project is one of the world’s largest and most economically robust underdeveloped copper projects

- A proposed IPO of McEwen Copper, with its implied market cap of $258 million, could effectively turbocharge the balance sheet of McEwen Mining

SideChannel Inc. (SDCH) Releases New Product, Enclave(TM), a Zero-Trust Cybersecurity Offering for Small to Mid-Sized Businesses

- SideChannel uses microsegmentation to reduce risk, enhance productivity, and implement zero-trust networks

- Going beyond traditional open Hub & Spoke and Mesh models, Enclave(TM) benefits SideChannel customers with faster breach containment, simplified compliance, and kills VPN connections that limit productivity

- The global cybersecurity market size is projected to grow from $189.9 billion in 2023 to $266 billion by 2027, at a CAGR of 8.9%

- Faster Breach Containment – shrinks the attack surface, meaning there are fewer surface areas to search for breaches.

- Simplifies Compliance – reduces the time to containment by reducing the surface area visible to an intruder. It limits the scope of a post-event search to uncover situational facts.

- Kill VPN – with remote work becoming a preferred reality, it is becoming increasingly easier to breach data. VPN tunnels slow down networks, and productivity is lost, along with information, making costs go up.

Hillcrest Energy Technologies Ltd. (CSE: HEAT) (OTCQB: HLRTF) Gears up for 2023; Expands Focus to New Products and End Uses of Its ZVS Inverter Technology to De-Risk and Potentially Accelerate Race to Commercial Revenues

- Hillcrest – an innovative developer of next-gen technologies for EV powertrains and grid-connected renewable energy systems – is looking forward to a promising 2023 as its target market remains buoyant: sale of zero-emission vehicles continues to exceed expectations, and renewables appear on track to become the largest global source of electricity by 2025

- Aligned with these market developments, the company remains committed to building momentum gained in 2022; looks to expand its focus to include grid-tied applications while maintaining and growing relationships in the automotive sector;

- Hillcrest eyes engagement with potential customers across multiple sectors, aiming to position itself to secure commitments for commercial revenues by year-end; expects its growing IP portfolio to give a strong boost to the company’s perceived market value and maturing business strategy

Meeting 2050 Decarbonization Targets is Grounded on Retrofitting Current Spaces, and Correlate Infrastructure Partners Inc. (CIPI) Is Out to Meet the Growing Demand

- The built environment currently accounts for nearly 40% of the world’s carbon emissions, with the figure expected to double by 2060

- The current administration has already set the goal of reducing the carbon footprint of the U.S. building stock by 50% come 2035, in addition to meeting the net-zero carbon emissions goals by 2050

- Experts have pointed to the use of technology as the answer to reducing buildings’ carbon footprint, and retrofitting existing buildings has proven to be a viable way of achieving the carbon goals, which is what Correlate is all about

- Correlate recognizes the opportunity at hand and looks to capitalize on it to not only push the retrofitting conversation forward but also provide the necessary systems, infrastructure, and services that facilitate these retrofits

- Breaking Down Barriers To Your ESG Goals While Generating Additional Net Operating Income: www.CorrelateInfra.com/our-process

- Platform Generates New Rent And Operating Income, Allowing You To Meet Your ESG Goals: www.CorrelateInfra.com/program

EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQX: EVGIF) is Developing Canada’s RNG Network as RNG Projects Ramp Up Worldwide

- Many countries throughout the world are incorporating RNG into their carbon-reduction strategy, including China, India, Europe, Canada, and the United States

- EVGIF is building RNG infrastructure in Canada, starting in British Columbia and moving east with projects in Alberta and Ontario

- RNG is pipeline-quality gas that is equivalent to natural gas, compatible with existing pipeline networks

- Expansion of EVGIF’s RNG network is made possible through long-term offtake agreements from Canada’s highly regulated utility companies

From Our Blog

Soligenix Inc. (NASDAQ: SNGX) Driving Innovation in Photodynamic Therapy Potential in Oncology, Dermatology

February 10, 2026

From lab research to clinical application, photodynamic therapy (“PDT”) is emerging as a powerful treatment approach that uses light and chemistry to selectively target diseased tissue. As this modality gains attention for its precision and safety profile, Soligenix (NASDAQ: SNGX) is developing light-activated therapies designed to treat cutaneous T-cell lymphoma (“CTCL”) and other inflammatory skin […]