- Correlate Infrastructure Partners recently completed a name and ticker rebranding effort on the OTCQB exchange as part of its effort to clarify its identity and success with portfolio clean energy solutions in North America

- Correlate Infrastructure Partners provides turnkey development and finance services to help commercial and industrial facilities reduce their use of fossil utilities thus reducing their carbon footprint

- The company recently acquired Correlate Inc. a national leader in locally sited solar, energy storage, EV infrastructure and intelligent efficiency measures

- Worldwide, countries are working to implement strategies for climate harm reduction following a 2015 Paris agreement supervised by the United Nations and reducing building greenhouse gas emissions has the potential to make a huge dent in their goals

Stocks To Buy Now Blog

All posts by Christopher

The Southeastern Hemp & Medical Cannabis Convention, Helping to Shape The Future Of The Industry

Cannabis growers, traders, businesses, researchers, processors, testing laboratory personnel, facility management, and investors, are all invited to attend the SHMC (Southeastern Hemp & Medical Cannabis) Convention being held from the 12th to the 14th of May, 2022, at the Cobb Galleria Centre, Two Galleria Parkway, Atlanta, Georgia. The event, also to be streamed online for worldwide access, is organized by Organa Kannalytics LLC.

The SHMC offers a robust platform for startups and industries to identify novel avenues of growth in this dynamic and budding industry. This convention attracts a vast profile of attendees from varied industry verticals seeking investment and business opportunities in the medical cannabis sector.

Growing businesses can attain insights from distinguished speakers about the medical advancements, technological breakthroughs, legislative laws, and business prospects of the cannabis industry amidst the growing competition in the Southeastern U.S. region. This forum is all set to witness some of the strongest cannabis players looking to redefine the industry.

The emerging hemp and medical cannabis market offers a spectrum of possibilities waiting to be explored. Entrepreneurs, medical practitioners, cultivators, and traders can leverage the mammoth networking scope of this impactful 2-day event to tap the huge cannabis market at their disposal.

LUX LEAF Diagnostics, the title sponsor of SHMCC, is a leading testing laboratory dedicated to serving the US market. Sponsors and vendors can set up their individual booths or showcase their products and services. Earlybird discounts are available.

Speakers include:

- Tavarres King – King is a veteran player of the National Football League, and CEO of Rowdy Wellness, an Atlanta-based CBD company engaged in the research, education, and development of quality health and wellness products.

- Dallas Austin – Austin is a legendary songwriter, now owner of Rowdy Wellness, and an active cannabis advocate down south

Boost Your Cannabis Business in Medellin as BizCann Expo Brings The Best Cannabis Services Together, Under One Roof!

Cannabis entrepreneurs, brand owners, and enthusiasts are all invited to the next edition of BizCann Expo in Medellín, Colombia this May 21-22nd 2022. Having hosted some phenomenal trade shows in numerous cities of the US, BizCann Expo is happy to announce their upcoming event in Medellin, helping local businesses expand and discover global avenues.

BizCann Expo is the perfect launchpad for unique business ideas, sharing innovations with industry peers and leaders, as well as discussing the various aspects and strategies for successful cannabis trading. Attendees can showcase their products and services with exhibitors, and those with in depth knowledge of the field can join the show as speakers!

This event aims to provide valuable information on the latest cannabis market trends, and offers a huge arena for joint venture collaborations. Participants can enjoy a variety of discussions, keynotes, and workshops. Plus, they’ll be able to find all resources that businesses need to grow and establish themselves in the cannabis industry. Here’s a few other things you can expect:

- Learn about the latest cannabis legislations and attain CLE credits

- Exhibit your talents and services to an enthusiastic audience, for a chance to be discovered by investors

- Explore tactics for maintaining best practices and accounts in your cannabusiness

- New businesses can learn directly from industry leaders at their selection of seminars, talks and panels

- Discover an entire spectrum of resources necessary for kickstarting your cannabis business

Finovate Edge: Lendtech – Gateway For Transitioning To Digital Lending

Traders, analysts, businesses, and experts in consumer and commercial lending within banks, fintech, and other financial institutions are invited to attend a power-packed virtual session, Finovate Edge: Lendtech, on disruptive digital lending organized by The Finovate Group. The Finovate Group is a premier institution focused on research, analysis, and innovation in financial and banking technology.

Get ready to witness cutting-edge insights from the influencers and experts of the digital lending niche, plus, learn and understand the latest industry trends and challenges, all in under 3 hours. The phenomenal bunch of speakers in 2022 includes Curve, Laybuy, Tide, QED Investors, FISPAN, Activant Capital, Home Credit, and more!

Discover the best bite-size content on this virtual platform. Attendees can join and interact with their peers and experts anywhere in the world. Some of the attendees include CrossLend, ITF Group JSC, MO Technologies, Currencycloud, Aracar Group, JMMB Express Finance, Federal Reserve Bank of Philadelphia, and more!

Greg Palmer, Vice President of Finovate will kick start the event by welcoming the attendees, guest speakers, and more. Some important topics to be covered are:

- Digital analysts will reveal the top digital lending trends to help you understand and build your strategy going forward

- Best practices and things to know before diving into the digital lending process

- Explore real business solutions on how to manage the implementation and succeed in the digital lending space

- Futurist insights on the best moves and risks to avoid to win as a lender

- Become a market leader and learn how to improve the consumer experience as you move ahead in your lending journey

- Future of digital lending and what opportunities can you seize

- Key criteria to effective lending fraud prevention technology

- Embedded lending: Creating a new line of lending techniques for a better consumer experience

- Guide to accessing resources and tips from the risk experts

Florida Bitcoin & Blockchain Summit To Explore Best Business Opportunities In the Blockchain and Financial Technology Sector

The Florida Bitcoin & Blockchain Summit hosted by Cutting Edge Events LLC, invites businesses, stakeholders, influencers, regulators, and leaders of the fintech arena, to attend an expansive bitcoin and blockchain event at Hilton Orlando, on May 26-27, 2022. The two-day event will offer expertise on the fast-moving fintech business, explore the blockchain and bitcoin economies in Florida, and discuss important issues in the digital asset space.

Cutting Edge Events LLC specializes in hosting hi-tech large-scale events attracting media attention and global acknowledgment. The Florida conference will be graced by industry leaders respected for their many contributions to the fintech space. They will share their insights and views on the future of this evolving modern finance sector.

The Florida Bitcoin & Blockchain summit offers a wonderful platform for traders, influencers, and game-changers of the industry, there to actively connect and collaborate. This summit, while focusing on the Florida Bitcoin and Blockchain economy, welcomes global businesses to come together and discuss the prospects of business in the region.

These industry stalwarts will guide and educate budding companies about the new financial ecosystem that offers unlimited scope and prospects for placing their bets in the digital finance market. Fintech communities and industry leaders will decide and draw strategies that will put Florida on the center stage for becoming a global leader in cryptocurrency, blockchain, and financial technology.

The conference is curated for:

- Beginners- Young entrepreneurs foraying into the fintech space and enthusiasts eager to learn about the fintech and Blockchain investing

- Stakeholders– investors, businesses, capitalists and institutions who want to learn the intricacies of the financial technology trade to invest before others take the plunge

- Advocates– leaders and institutes of the region who want to establish Florida as a leading arena in fintech trade, keeping in mind all laws and regulations of fair trading.

SRAX Inc. (NASDAQ: SRAX) Reports Increased Interest from Institutional Investors; Unveils Plans to Expand into Cross-Organizational Integrated Solutions

- SRAX remains committed to developing tools that empower public companies to thrive in an increasingly challenging business environment

- After successfully building a host of products that help public companies get noticed in the investor community, SRAX is looking into expanding beyond the investor relation space to include cross-organizational tech solutions

- With a business catapulting over the past year, the company has seen a soar in interest from investors with a significant increase in adoption from institutional players

Silo Pharma Inc. (SILO) Advances with Pharmacokinetic Study – but What is Pharmacokinetics?

On March 31, 2022, Silo Pharma (OTCQB: SILO) announced an agreement with contract research organization Frontage Laboratories for an Investigational New Drug (“IND”)-enabling, “Pharmacokinetic Study.” Silo merges traditional therapeutics with psychedelic research to relieve patients suffering from PTSD, Alzheimer’s, Parkinson’s, and other rare neurological disorders. Frontage will study Silo’s Central Nervous System Peptide, SPU-16, “a potential new treatment for multiple sclerosis and other conditions,” and their Joint Homing Peptide, SPU-21, used for treating arthritogenic processes, which, according to Silo Pharma CEO Eric Weisblum, could, “enhance the therapeutic effect of current and future therapeutics while decreasing potential systemic toxicity….They may be used to treat both Central Nervous System and Autoimmune Diseases.”

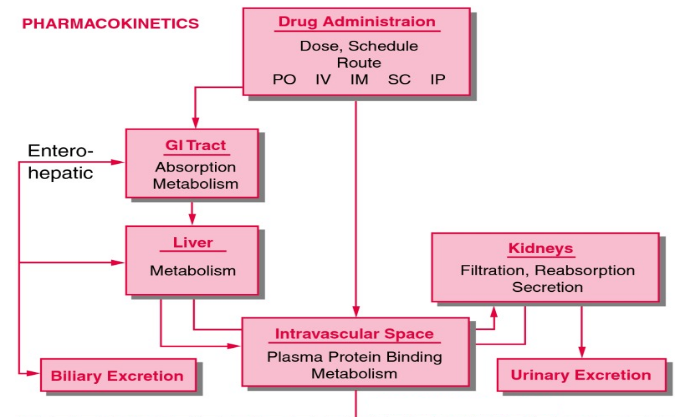

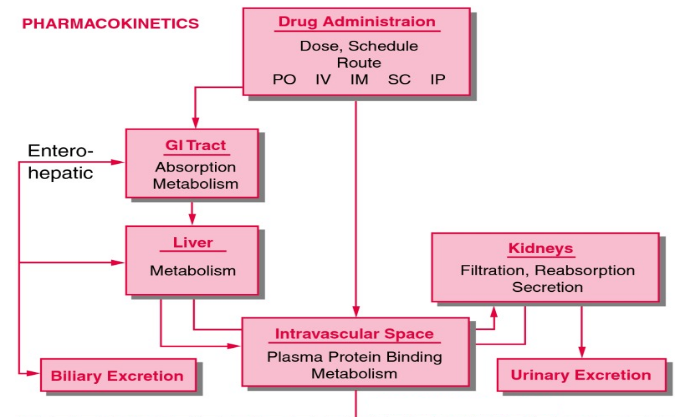

Pharmacodynamics studies the reactions between drugs and organisms or, simply, the effect of a drug on the body, allowing for a patient’s existing diseases or conditions, their age and other drugs they’re currently taking. Conversely, pharmacokinetics studies the body’s effect on a drug, its “absorption, distribution, metabolism, and excretion,” or the ways and rates a therapeutic enters, courses through, is modified by and finally exits the system.

DMPK (drug metabolism and pharmacokinetics) constitutes a “core discipline in drug development” for assessing drug safety. According to a Frontage Labs factsheet, DMPK studies provide critical research data, assisting therapeutics innovators like Silo to reach important milestones and “decision making during drug discovery and development.” Weisblum says the agreement (with Frontage), “significantly advances our Central Nervous System Peptide, SPU-16, and our Joint Homing Peptide, SPU-21 technologies closer to the clinic.”

For a closer look at Pharmacokinetics, check out: The National Library of Medicine, Technology Networks: Drug Discovery, the XenoTech Blog and the Frontage Resource Library.

Silo Pharma, headquartered in Englewood Cliffs, New Jersey, identifies assets to license and also funds research to better serve patients and advance the health care industry. Recent achievements include a research agreement with Columbia University developing psychedelic therapeutics for Alzheimer’s disease, DEA approval advancing (with Zylo Therapeutics) Z-Pod technology for delivering time-released Ketamine or Psilocybin, a patent for Silo’s Central Nervous System Homing Peptide, granted by the United States Patent and Trademark Office and a sponsored research agreement with UMB evaluating the pharmacokinetics of dexamethasone delivered to arthritic rats via liposomes.

For Silo Pharma’s most recent news, click here.

Silo Pharma

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, NJ 07632

For more information, visit the company’s website at www.SiloPharma.com.

NOTE TO INVESTORS: The latest news and updates relating to SILO are available in the company’s newsroom at https://ibn.fm/SILO

DMPK (drug metabolism and pharmacokinetics) constitutes a “core discipline in drug development” for assessing drug safety. According to a Frontage Labs factsheet, DMPK studies provide critical research data, assisting therapeutics innovators like Silo to reach important milestones and “decision making during drug discovery and development.” Weisblum says the agreement (with Frontage), “significantly advances our Central Nervous System Peptide, SPU-16, and our Joint Homing Peptide, SPU-21 technologies closer to the clinic.”

For a closer look at Pharmacokinetics, check out: The National Library of Medicine, Technology Networks: Drug Discovery, the XenoTech Blog and the Frontage Resource Library.

Silo Pharma, headquartered in Englewood Cliffs, New Jersey, identifies assets to license and also funds research to better serve patients and advance the health care industry. Recent achievements include a research agreement with Columbia University developing psychedelic therapeutics for Alzheimer’s disease, DEA approval advancing (with Zylo Therapeutics) Z-Pod technology for delivering time-released Ketamine or Psilocybin, a patent for Silo’s Central Nervous System Homing Peptide, granted by the United States Patent and Trademark Office and a sponsored research agreement with UMB evaluating the pharmacokinetics of dexamethasone delivered to arthritic rats via liposomes.

For Silo Pharma’s most recent news, click here.

Silo Pharma

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, NJ 07632

For more information, visit the company’s website at www.SiloPharma.com.

NOTE TO INVESTORS: The latest news and updates relating to SILO are available in the company’s newsroom at https://ibn.fm/SILO

DMPK (drug metabolism and pharmacokinetics) constitutes a “core discipline in drug development” for assessing drug safety. According to a Frontage Labs factsheet, DMPK studies provide critical research data, assisting therapeutics innovators like Silo to reach important milestones and “decision making during drug discovery and development.” Weisblum says the agreement (with Frontage), “significantly advances our Central Nervous System Peptide, SPU-16, and our Joint Homing Peptide, SPU-21 technologies closer to the clinic.”

For a closer look at Pharmacokinetics, check out: The National Library of Medicine, Technology Networks: Drug Discovery, the XenoTech Blog and the Frontage Resource Library.

Silo Pharma, headquartered in Englewood Cliffs, New Jersey, identifies assets to license and also funds research to better serve patients and advance the health care industry. Recent achievements include a research agreement with Columbia University developing psychedelic therapeutics for Alzheimer’s disease, DEA approval advancing (with Zylo Therapeutics) Z-Pod technology for delivering time-released Ketamine or Psilocybin, a patent for Silo’s Central Nervous System Homing Peptide, granted by the United States Patent and Trademark Office and a sponsored research agreement with UMB evaluating the pharmacokinetics of dexamethasone delivered to arthritic rats via liposomes.

For Silo Pharma’s most recent news, click here.

Silo Pharma

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, NJ 07632

For more information, visit the company’s website at www.SiloPharma.com.

NOTE TO INVESTORS: The latest news and updates relating to SILO are available in the company’s newsroom at https://ibn.fm/SILO

DMPK (drug metabolism and pharmacokinetics) constitutes a “core discipline in drug development” for assessing drug safety. According to a Frontage Labs factsheet, DMPK studies provide critical research data, assisting therapeutics innovators like Silo to reach important milestones and “decision making during drug discovery and development.” Weisblum says the agreement (with Frontage), “significantly advances our Central Nervous System Peptide, SPU-16, and our Joint Homing Peptide, SPU-21 technologies closer to the clinic.”

For a closer look at Pharmacokinetics, check out: The National Library of Medicine, Technology Networks: Drug Discovery, the XenoTech Blog and the Frontage Resource Library.

Silo Pharma, headquartered in Englewood Cliffs, New Jersey, identifies assets to license and also funds research to better serve patients and advance the health care industry. Recent achievements include a research agreement with Columbia University developing psychedelic therapeutics for Alzheimer’s disease, DEA approval advancing (with Zylo Therapeutics) Z-Pod technology for delivering time-released Ketamine or Psilocybin, a patent for Silo’s Central Nervous System Homing Peptide, granted by the United States Patent and Trademark Office and a sponsored research agreement with UMB evaluating the pharmacokinetics of dexamethasone delivered to arthritic rats via liposomes.

For Silo Pharma’s most recent news, click here.

Silo Pharma

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, NJ 07632

For more information, visit the company’s website at www.SiloPharma.com.

NOTE TO INVESTORS: The latest news and updates relating to SILO are available in the company’s newsroom at https://ibn.fm/SILO

From Shell (NYSE: SHEL) to EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF) Renewable Natural Gas is a Market Investors Should be Watching

- There is an accelerating trend to utilize Renewable Natural Gas (“RNG”), including investments by companies big and small to produce RNG from waste to greatly reduce carbon emissions

- Shell has its first U.S. facility in Oregon and agreements to provide RNG to power busses and garbage trucks in Los Angeles

- EverGen Infrastructure Corp. owns Western Canada’s first producing RNG facility and is making acquisitions to ensure its leadership market position in part through a relationship with FortisBC

- EverGen has made its move eastward through a new RNG agreement in Alberta and expects to continue this path with moves into Ontario and Quebec

O’Cannabiz International Conference and Expo to Feature a Retail Summit and Awards Gala

The wait is finally over. Following last year’s rescheduling due to the pandemic, Canada’s premier cannabis event is set for June 1-3rd. On its return to Toronto, the O’Cannabiz International Conference and Expo will feature a VIP Conference, the 3rd annual Awards Gala, and a Retail Summit.

To register, visit the following link: https://ocannabiz.com/toronto/register.

O’Cannabiz will take place at the International Center in Mississauga, Ontario, Canada. The event is expected to host more than 3,500 attendees and over 180 speakers. The O’Cannabiz VIP Conference is set for June 1st and has a pool of influential speakers such as Derrick Berney, the CEO and Founder of Cannabis Wiki, and Donna Johannson, the Founder and Design Executive of Canadian Women in Cannabis (“CWIC”). Attendees will also have the opportunity to watch a Cooking Demo with Chef Pat Newton and Justin Renfrow.

The O’Cannabiz Industry Awards Gala will feature over 50 awards in 5 different categories to honor the top performing cannabis professionals and companies. The event is set for June 1st, 6:15 pm to 9 pm at Casa Loma – Toronto. There will be a 45-minute Red Carpet Royalty Cocktail Reception before commencing the dinner and awards session from 7 pm to 9 pm. Gerry Dee, Host of Family Feud Canada, will host the Awards Dinner Gala. VIP delegates, exhibitors, and sponsors will be treated to a lavish VIP Networking After Party from 9 pm to 11 pm at The Glass Pavilion, Casa Loma.

A 2-day Retail Summit and Expo will happen from June 2-3rd. The Retail Summit will be a training program focusing on the needs and goals of cannabis retailers. During this period, exhibitors will showcase their products and solutions in a 50,000 SQ. FT. Expo Hall. The Retail Summit and Expo will be an excellent opportunity for retailers to network and learn about cannabis retail success solutions.

Visit the O’Cannabiz website to learn more about this year’s event and purchase tickets: https://ocannabiz.com/

InnerScope Hearing Technologies Inc. (INND) Continues to Change the Face of Hearing Care with Hearing Devices That Are More Discrete, Affordable, and Convenient to Get Than Ever Before

- Hearing loss is affecting a large number of people, and the number is only to increase with the aging population

- Still, many don’t wear hearing aids as they are expensive, often clunky, and inconvenient to get

- INND continues to solve these pain points, empowering consumers to take control of their hearing health with its unique top-quality Direct-to-Consumer (“DTC”) hearing aids

From Our Blog

Forward Industries Inc. (NASDAQ: FWDI) Gains Buy Rating as Solana-Focused Treasury Strategy Strengthens Outlook

December 17, 2025

Forward Industries (NASDAQ: FWDI) is the focus of a new analyst report from Oak Ridge Financial, which reiterates a Buy rating and establishes a $10 price target. The report highlights the company’s ongoing transformation into the world’s largest Solana-based Digital Asset Treasury (“DAT”) and evaluates why analysts believe the company may be positioned for long-term […]