- Lexaria Bioscience is a global innovator in drug delivery platforms that has developed the patented DehydraTECH(TM) technology for improved delivery of bioactive compounds

- The company is currently evaluating DehydraTECH-processed CBD as a potential treatment for high blood pressure

- Long-term studies have shown that high blood pressure can increase the risk of developing dementia in later life

- Experts, however, believe that hypertension medication could slow the pace of the cognitive decline

- In addition to helping hypertension patients keep their condition under control, Lexaria’s DehydraTECH-CBD, which has so far been shown to be safe and well tolerated, could potentially help reduce the risk of dementia

Blood pressure or BP typically refers to the pressure exerted by circulating blood against the walls of blood vessels, particularly large arteries and veins. This pressure fluctuates throughout the day depending on the activity in which one engages. However, in some instances, it can consistently cross the normal threshold, a condition known as high blood pressure or hypertension. Usually, and based on a 2017 guideline, a person is said to have high BP when the top reading on the blood pressure monitor, which represents the systolic blood pressure, is greater than 130 mmHg while the bottom reading, which denotes the diastolic pressure, is above 80 mmHg (

https://ibn.fm/b9JpP).

The constant exertion of elevated pressure on blood vessels damages them by making them less elastic. According to the Centers for Disease Control (“CDC”), this decreases the flow of blood and oxygen to the heart and other body organs. And it is this depressed blood flow that causes progressive damage to organs such as the brain. Long-term research studies have, in fact, shown that high blood pressure among people who are around 40 to 64 years old can increase the risk of developing dementia in later life (

https://ibn.fm/gFrnt).

One such study, which probed the relationship between high blood pressure and later-life cognition and was published recently in the

Journal of Alzheimer’s Disease, found that “people with high blood pressure levels face faster erosion of their ability to think, make decisions, and remember information than those with normal blood pressure levels” (

https://ibn.fm/9iazB). And although the study’s findings suggest that hypertension causes faster cognitive decline, they fortunately also indicate that taking antihypertensive drugs could slow the pace of that decline, according to the study’s lead author Deborah Levine, M.D., M.P.H, the director of the Cognitive Health Services Research Program at the University of Michigan.

But while hypertension medication is linked to such benefits, patients often shun them, citing their adverse side effects. The resulting suboptimal adherence to existing drugs has given rise to a worrying statistic – according to the CDC, only about 24% of adults with hypertension have it under control, yet the condition causes over 670,000 deaths every year in the United States alone (

https://ibn.fm/6DfFl).

However, one company, a publicly traded global innovator in drug delivery technology known as

Lexaria Bioscience (NASDAQ: LEXX), is out to improve medication adherence and subsequently help prevent the cognitive decline linked to high blood pressure. For Lexaria and the hypertension patients it is targeting, the solution, which is still under development and evaluation, lies in DehydraTECH(TM)-processed cannabidiol (“CBD”).

In isolation, CBD has exhibited vasodilatory and antioxidant properties in humans and animals (

https://ibn.fm/tEpkA). Its positive effects on blood pressure have also been documented in various research articles, with one such study, which sampled 26 healthy males who were given 600 mg of CBD or placebo orally for seven days, finding that CBD reduces blood pressure at rest after a single dose, although the effect is lost after seven days of treatment. Still, the study showed that CBD resulted in prolonged BP reduction during stressful situations (

https://ibn.fm/40Qno).

These positive results notwithstanding, CBD is known to have a low oral bioavailability – the proportion of the ingested drug that enters the circulation. According to various reports, the oral bioavailability of CBD stands at approximately 6% (

https://ibn.fm/NUUjt), suggesting that users could potentially extract greater BP-related benefits. For Lexaria, which had developed and patented the DehydraTECH technology that enhances the bioavailability and bioabsorption of various lipophilic active pharmaceutical ingredients (“APIs”), this represented an opportunity that the company then exploited by processing CBD with DehydraTECH.

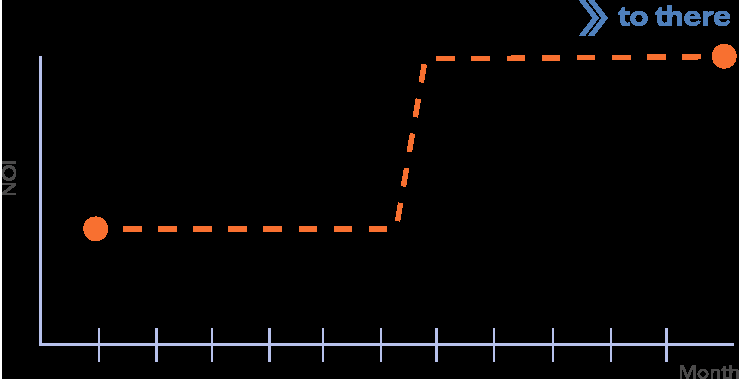

In a 2018 study, Lexaria observed that DehydraTECH delivered 317% more CBD to the blood than controls. And since then, the company has undertaken multiple human clinical studies. In three of the four studies, Lexaria has evidenced that DehydraTECH-CBD results in a rapid and sustained drop in BP, causes a 23% average reduction in overnight blood pressure and reduced arterial stiffness, and triggers attenuated pulmonary artery systolic pressure (

https://ibn.fm/WHdod). Results are pending from Lexaria’s largest ever human clinical trial, where dosing completed in July.

Backed by the positive findings, Lexaria sought and held a pre-Investigational New Drug (“IND”) meeting with the U.S. FDA, whereupon it received positive feedback and confirmation that supports an abbreviated regulatory pathway in line with section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act (“FD&C Act”). Currently, the company is undertaking requisite processes that are expected to culminate in the filing of an IND application later this year or early next year (

https://ibn.fm/7XlMN). Upon submitting the IND filing and receiving a response from the FDA, Lexaria will have the green light to proceed with registered clinical trials.

For more information, visit the company’s website at

www.LexariaBioscience.com.

NOTE TO INVESTORS: The latest news and updates relating to LEXX are available in the company’s newsroom at

https://ibn.fm/LEXX

Fossil fuels have dominated the energy supply chain for centuries. The transition from biomass energy production from burning wood to energy-dense stored-fuel sources such as coal and then oil, industrial productivity jumped along with population growth.

“The world today is unrecognizable from that of the early 19th century, before fossil fuels came into wide use,” Brookings Institution energy researcher Samantha Gross wrote in a report for the Washington, D.C.-based nonprofit public policy organization (

Fossil fuels have dominated the energy supply chain for centuries. The transition from biomass energy production from burning wood to energy-dense stored-fuel sources such as coal and then oil, industrial productivity jumped along with population growth.

“The world today is unrecognizable from that of the early 19th century, before fossil fuels came into wide use,” Brookings Institution energy researcher Samantha Gross wrote in a report for the Washington, D.C.-based nonprofit public policy organization (